New Scam Report Shows How Much It Will Cost You

It wasn’t long ago that I told you about a phone scam that one of my friends fell victim to. As I mentioned, she works in the cyber-security field, yet…

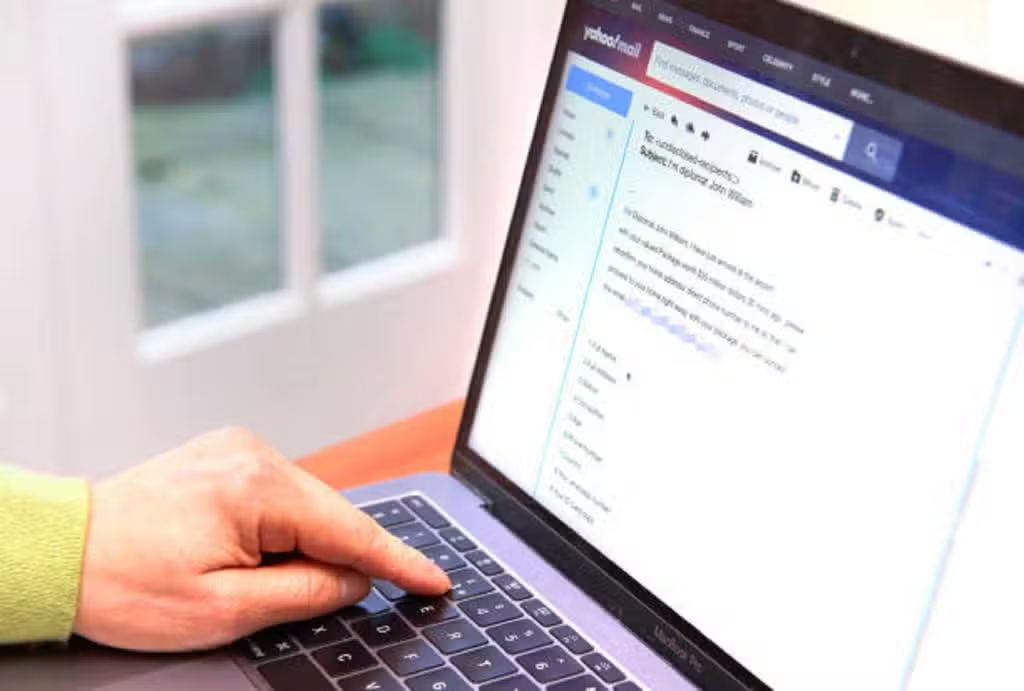

A spam ‘Phishing’ email is displayed on a laptop screen.

(Photo by Peter Dazeley/Getty Images)It wasn't long ago that I told you about a phone scam that one of my friends fell victim to. As I mentioned, she works in the cyber-security field, yet she still fell for it.

The phone scammer told her that he was from the Office of Homeland Security and fed her an elaborate tale about fake driver’s licenses in her name, and suspicious packages with drugs that were confiscated in Florida addressed to her home address in New Jersey.

Before she knew it thirty minutes had passed and she unwittingly shared much more information than she wanted to.

Fortunately, she never gave out any personal identifying information, but she did confirm information he had about her and said that she “probably added too much color about my life and it’s going to bother me for a long time.”

If it happened to her, it can happen to anyone. And it does, every day.

Alarming Scam Statistics

More recently, alarming scam statistics were reported by financial company IPX1031. According to their article, as each day passes, the more advanced and highly developed everyday fraud is becoming. This is making it much harder for us to differentiate between a legitimate phone call or email and one that’s designed to steal our money or identity.

The report by IPX1031 says that “1 in 3 Americans have been scammed in the last 12 months.” That means that if you have 2 friends, one of you has been fooled in the past year.

And age isn’t a factor. They looked at everyone from Gen Zers to Baby Boomers and the percentage was very close across the board. Millennials seemed to be the most savvy with only twenty-six percent of them falling victim to a scam. They were followed by Gen Xers at thirty-two percent, Gen Zers at thirty-seven percent, and Baby Boomers just a tick higher at thirty-eight percent.

How Much Money You Will Lose to a Scam

The study also found that almost half (forty-eight percent) of Americans are worried about falling for a scam. Rightfully so, because it’s estimated that each of us will lose an average of $2647 in our lifetime. The top scams include credit cards, online shopping, identity theft, phishing, and more.

Check out the full study by IPX1031 here.

Make Your Money Grow with These Low-Risk Investments

If you have some money wasting away in a savings account that doesn't have interest, then you might want to consider making your money grow with low-risk investments. Financial experts say that certain low-risk investments can really help pad your savings.

What Are Low-Risk Investments?

Before we get into the best low-risk investments, let's look at what exactly is a low-risk investment. The official definition is basically what you would expect from the definition of a low-risk investment. According to the financial experts at Capital.com, it's "an investment where there is perceived to be just a slight chance of losing some or all of your money. Low risk investments offer you a security blanket as they’re not likely to suddenly drop in value."

In contrast, according to Investopedia.com, "A high-risk investment is one for which there is either a large percentage chance of loss of capital or under-performance—or a relatively high chance of a devastating loss." They add that, "The first of these is intuitive, if subjective: If you were told there’s a 50/50 chance that your investment will earn your expected return, you may find that quite risky." So, for example, a 50/50 risk might not seem risky to some, but it might seem risky to others. An investment with a 99% risk will obviously seem risky to everyone. But, with high-risk investments come big payouts, so that's what lures people in. For example, a separate article from Investopedia.com states that some high-risk investments can double your money. That's obviously a much bigger return than you would see in your average investment. As they state, "Make no mistake, there is no guaranteed way to double your money with any investment. But there are plenty of examples of investments that doubled or more in a short period of time."

So, if you're interested in making a ton of money, or losing it all, high-risk investments such as investing in foreign emerging markets may be of interest to you. "A country experiencing a growing economy can be an ideal investment opportunity," experts at Investopedia.com state. "Investors can buy government bonds, stocks, or sectors with that country experiencing hyper-growth or ETFs that represent a growing sector of stocks." They add "spurts in economic growth in countries are rare events that, though risky, can provide investors with a slew of brand new companies to invest in to bolster personal portfolios."

Now, let's move onto some low-risk investments for those who don't want to risk losing their money. Of course, talk to your financial advisor before making any of these moves.

Invest in certificates of deposit (CDs)

You've probably heard of CDs being low-risk investments. Fidelity.com explains that "CDs provide reliable, fixed-rate returns on a lump sum of money over a fixed period of time, such as six months, one year, or five years." They add that the great thing is that if you "get a traditional CD at a bank or credit union where they are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Association (NCUA)." Usually, CDs have a minimum deposit, and you’ll have to pay a penalty if you take your money out too soon.

Getty Images / AaronAmat

High-yield savings accounts

High-yield savings accounts are like your regular savings account, but they earn more interest. "You can use these accounts for long-term savings goals or to hold extra money from your checking account," CreditKarma.com states. "For example, if you want to start saving for a house or building up an emergency fund, this could be a great option."

Getty Images /

U.S. treasury bills, notes and bonds

Forbes.com says that right now, the risk level for U.S. treasury bills, notes and bonds is "very low." They add that, "U.S. Treasury securities are backed by the full faith and credit of the U.S. government. Historically, the U.S. has always paid its debts, which helps to ensure that Treasurys are the lowest-risk investments you can own."

Getty Images / sommart

Money market funds

Fidelity.com states that, "Money market funds are mutual funds that invest in short-term, low-risk assets like Treasury and government securities, commercial paper, or municipal debt—depending on the focus of the fund." They add that, "Because their underlying investments are typically high quality, they are generally less volatile than other types of mutual funds, such as stock funds."

Getty Images / Khongtham

Fixed annuities

Fixed annuities are a pretty safe bet. As Forbes.com explains, "Fixed annuities are a popular type of annuity contract that are frequently used for retirement planning, but can also be useful for medium-term financial goals." They add that, "Sold by insurance companies and financial services companies, a fixed annuity guarantees a fixed rate of return over a set period of time, regardless of market conditions."

Getty Images / artisteer

Invest inside your comfort zone

People talk about stepping outside of their comfort zone in life, but really, investing isn't a place to do this. You know how much money you have to "play" with, so if you're worried about putting too much money in the market, these low-risk investments could still help you make money on your money.

Getty Images / Nattakorn-Maneerat